LME Brokers: Tech and Ops – A Breakfast Forum Recap

During LME Week 2025, Sinara hosted a Breakfast Forum: Tech, Ops and What’s Next

Sinara works with the world’s established and emerging metals brokers and exchanges.

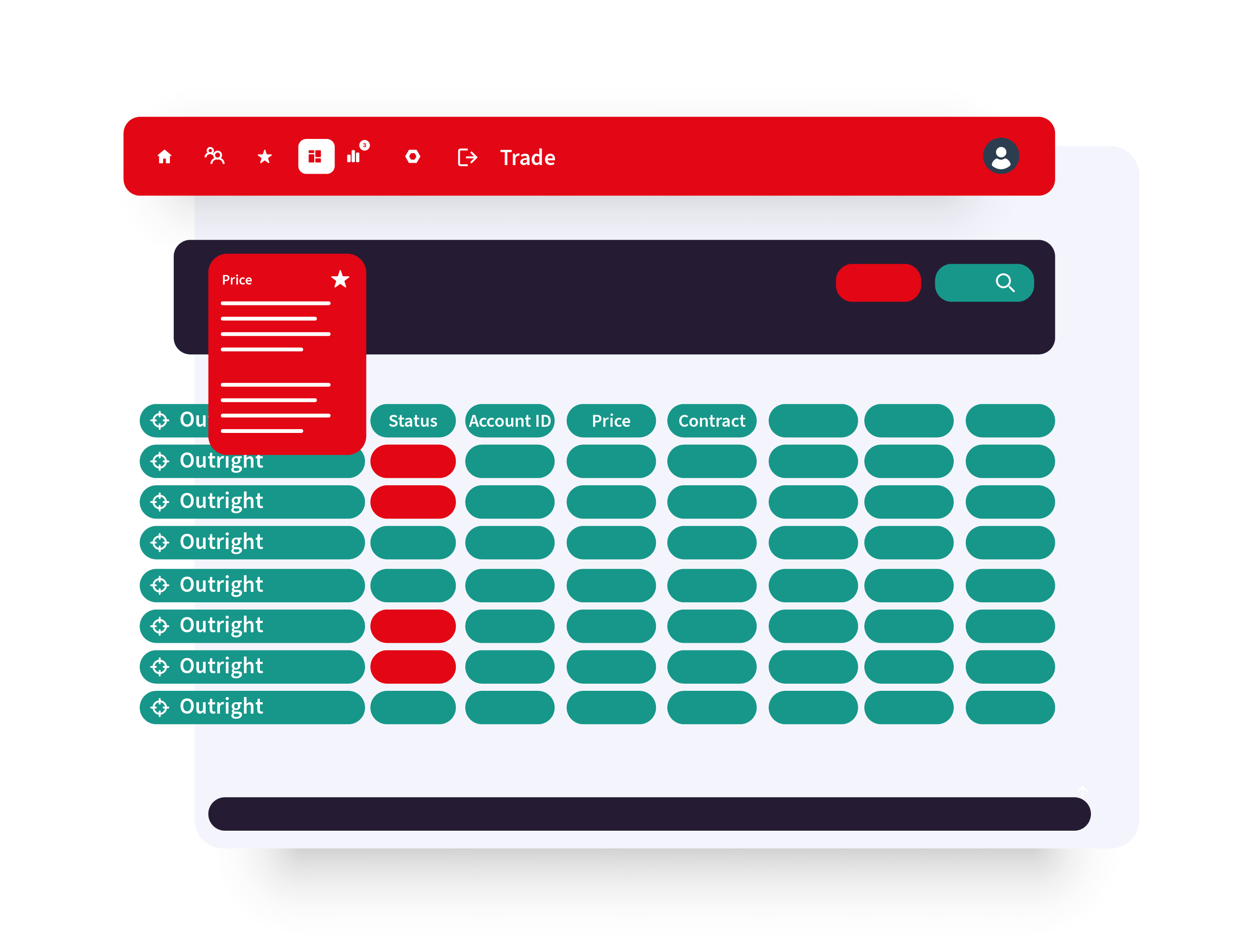

We design and implement end-to-end or point solutions for metals brokers and exchanges using customised modules from SinaraTLC, our pre-built library of trading components.

Heads of operations and trading, IT leaders, and business development leads in metals markets come to us to explore possibilities, help realise their vision, and drive future innovation through…

The client specialised in base metal futures and options trading, including participation in the LME market. In addition to futures, the client provides services such as warrant, bullion, and option trading. They wanted to transform their entire front-to-back trading technology suite to be able to boost efficiency, cut down manual and vendor risk, and prepare to expand into new business areas. Sinara delivered a TLC:Broker solution that comprehensively delivered on their needs.

We have worked in the metals markets for 15 years and understand the very specific challenges, processes and integrations facing specialist brokers and exchanges.

Metals trading has distinct characteristics that set it apart from trading other commodities. Metals makes up a unique trading segment within the commodities market, requiring specialised knowledge, tools, and strategies.

If we can help or advise on a specific piece of operational technology or integration, or you would like to discuss our end-to-end trading solutions, please get in touch.

Headed up by Tom Habibi, this team is at the forefront of software development for this market. Tom is highly knowledgeable about the nuances of the metals market and puts all new team members through an extensive induction to bring them up to speed with the specific trading processes and challenges of the metals market.

Headed up by Tom Habibi, this team is at the forefront of software development for this market. Tom is highly knowledgeable about the nuances of the metals market and puts all new team members through an extensive induction to bring them up to speed with the specific trading processes and challenges of the metals market.

Specialists solutions sales is led by Hamish Adourian. Hamish joined the business 20 years ago as a software developer. During that time, he has built a reputation in the design and development of systems for exchange operations, metals trading and market data distribution. He has deep knowledge of the metals trading life cycle and bridges the gap between the technical and the commercial.

Specialists solutions sales is led by Hamish Adourian. Hamish joined the business 20 years ago as a software developer. During that time, he has built a reputation in the design and development of systems for exchange operations, metals trading and market data distribution. He has deep knowledge of the metals trading life cycle and bridges the gap between the technical and the commercial.

The metals team has worked on some of Sinara’s biggest trading projects including high performance feed handlers, trading platforms, pricing engines, and order management systems. We have brought technical expertise and market knowledge to bear in the design of solutions to streamline the trading lifecycle and bring new services to market.

During LME Week 2025, Sinara hosted a Breakfast Forum: Tech, Ops and What’s Next

Sinara was recently featured in a Mondo Visione article highlighting the upcoming London Metal

For years, small and start-up exchanges—particularly those in emerging markets—have relied on large, off-the-shelf

Introduction Over the past few years, we’ve been steadily expanding our test automation capabilities

Introduction As derivatives and commodities markets become ever more competitive, exchange members need every

On 15th May 2025, we hosted our latest webinar, The Tech Pulse of the