Transforming Non-Exchange Traded Metals with Cutting-Edge Trading Solutions

Digital warehouse receipt listing, management & trading A new international exchange wanted to introduce a modern B2B trading platform for

Bespoke platforms can take years to spec and build, and investors want to see a rapid return on investment. Keeping upfront costs low and solutions agile helps start-ups deliver a healthy margin quickly.

Outsourcing the management of trading solutions allows new businesses to concentrate on launch and growth without the need for big in-house IT teams.

Cloud-based, scalable solutions allow for secure remote access, digital innovation and proof of concept without heavy upfront investment.

We work with start-up brokers and online exchanges to build rapid cost-effective trading solutions which cover execution through to settlement. In most new businesses we are able to customise modules from SinaraTLC, our fast to market solution for critical trading processes.

Digital warehouse receipt listing, management & trading A new international exchange wanted to introduce a modern B2B trading platform for

Intelligent throttling to handle high data volumes in online equity, CFD trading and spread betting

Consolidated data feed allowed leading provider of global financial information to live stream market data

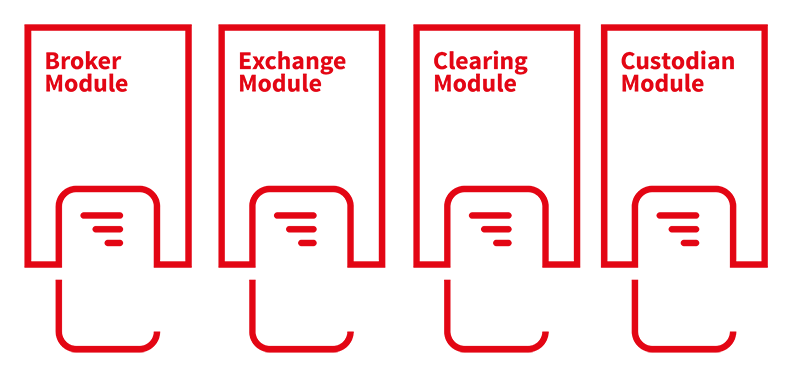

Trading Platform: Ready to Go

A rapid build modular trading solution

SinaraTLC is a set of trading hubs which can be adapted for brokers, exchanges, clearers or custodians. Each hub contains a series of functional modules and user interfaces which Sinara customise to meet client requirements. The modules can run as stand-alone applications or be integrated as an end-to-end trading platform.

Over the years we have built deep understanding of the entire trading lifecycle. Our teams have listened, understood, and designed back-ends, web/mobile applications and user-interfaces to make the trading lifecycle work more smoothly.

Sinara works with commodities brokers and exchanges to identify issues, understand requirements, and recommend solutions whether it be a web tool, mobile app, pricing tool or algorithm.

We have worked in metals trading for more almost 30 years, delivering many projects for the London Metal Exchange, bringing together technical expertise and market knowledge to streamline the trading lifecycle and commercialise market data.

At Sinara, we are constantly looking for ways to take advantage of the latest technology to drive better solutions for exchanges, clearing houses, and, of

During LME Week 2024, we had the pleasure of hosting a group discussion, facilitated by Sinara and Kynetix, to talk about challenges and practical solutions

The digitalisation of commodity trading is still very much an evolving area that promises to bring new efficiency, transparency, and security, offering substantial benefits to